January 2026 Federal Deposit Shifts Explained: Why $2,000 Refund Expectations Aren’t the Same for Everyone

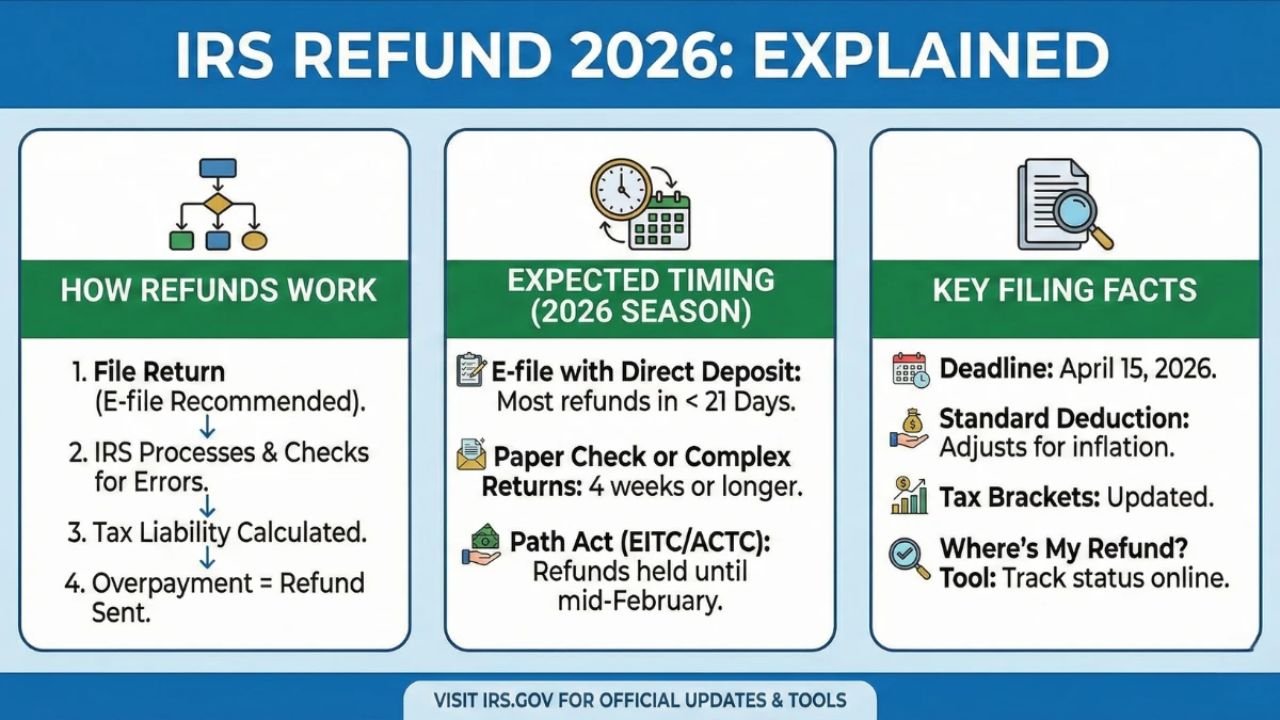

As January 2026 unfolds, many Americans are tracking federal deposits and hoping for refunds around $2,000. While headlines may suggest a universal payment, the reality is that refund timing and amounts vary widely. Understanding how the Internal Revenue Service (IRS) processes refunds, why deposits shift, and what affects final amounts helps taxpayers plan and avoid … Read more