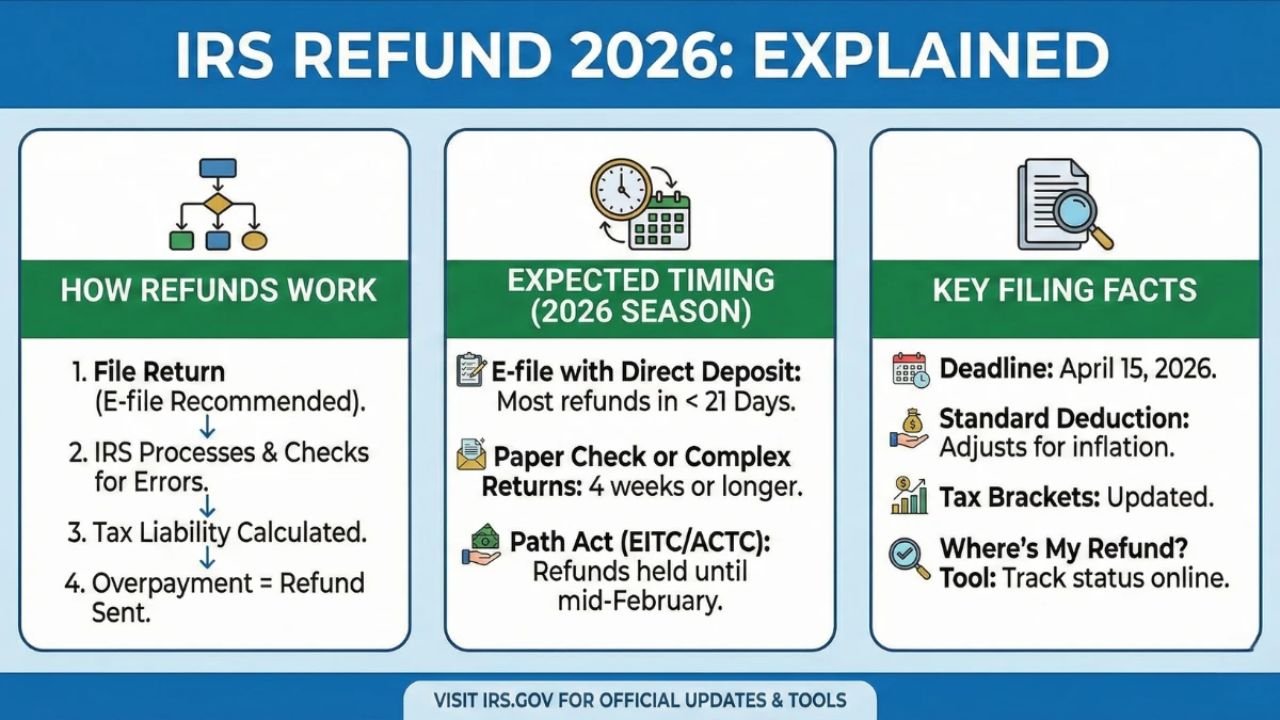

With the 2026 tax season underway, many Americans are searching for clarity on IRS refunds, including when payments are issued and why some filers receive larger refunds than others. It is important to understand that refunds are not bonuses or special payouts; they result from overpaid taxes, eligible credits, and accurate filing. This guide explains the official IRS refund process, expected timelines, and key facts taxpayers should know.

How IRS Refunds Actually Work

An IRS refund occurs when a taxpayer pays more tax than they owe during the year. This can happen through:

- Payroll withholding

- Estimated tax payments

- Refundable tax credits

Refund amounts vary based on income, deductions, credits, and filing accuracy. Each taxpayer’s situation is unique, so there is no universal refund amount.

When IRS Refunds Are Issued in 2026

Refund timing depends on how and when a return is filed. Electronically filed returns with direct deposit are processed faster than paper returns. The IRS does not have a single payout date for all taxpayers; instead, refunds are issued as returns are processed and verified.

Typical IRS Refund Timeline

| Filing Method | Expected Refund Time |

|---|---|

| E-file + direct deposit | About 21 days |

| E-file + paper check | Longer than 21 days |

| Paper return | Several weeks or more |

| Returns requiring review | Additional delays possible |

| Refunds involving credits | Later release dates by law |

Why Some Taxpayers Receive Larger Refunds

Larger refunds are usually the result of:

- Refundable credits, such as the Earned Income Tax Credit (EITC) or Child Tax Credit

- Higher withholding during the year

- Changes in income or deductions

These are not new payments but reflect tax rules applied to individual circumstances. Eligibility rules must be met for each credit.

Important IRS Refund Rules to Know

Refunds are released only after a return is fully processed and verified. Delays can occur due to:

- Missing or incorrect information

- Identity verification requirements

- Manual review of refundable credits

The IRS does not accelerate refunds for special requests or personal situations.

Key Dates That Matter

Refund timing is influenced by:

- When the IRS opens the tax season

- The date your return is filed

- Whether credits requiring mandatory review are claimed

Some refunds, especially those involving refundable credits, are legally held until later in the processing cycle to ensure compliance.

How to Track Your Refund

The most reliable way to check your refund status is through the IRS “Where’s My Refund?” tool or the IRS2Go mobile app. These tools provide real-time updates showing:

- Return received

- Return approved

- Refund sent

Relying on unofficial sources or social media can lead to misinformation.

Key Facts Taxpayers Must Know

- IRS refunds are based on overpaid taxes or eligible credits

- There is no guaranteed refund amount for everyone

- Most e-filed refunds are issued within about 21 days

- Refunds involving credits may be delayed by law

- Official IRS tools are the only source for accurate tracking

Conclusion

IRS refunds in 2026 follow standard processing rules rather than special payout schedules. Refund amounts and timing depend entirely on individual tax situations, filing accuracy, and eligibility for credits. Filing early, accurately, and using direct deposit can help receive refunds more efficiently. To avoid confusion and misinformation, taxpayers should rely exclusively on official IRS guidance.

Disclaimer

This article is for informational purposes only and does not constitute tax, legal, or financial advice. Refund amounts and timelines depend on individual filings and official IRS procedures.